Any difference between invoice price and reduced price (i.e., the price that is finally received from the customer) is known as allowance. This allowance should not be confused with the sales discount, which is initially entered in the cash receipts journal at the time of receiving cash from buyers. The sales allowance is granted to buyers for the above-mentioned reasons, whereas the sales discount is granted for quick and timely payments.

Get in Touch With a Financial Advisor

- All income statement accounts with credit balances are debited to bring them to zero.

- You can set-up a sales returns and allowances account by opening an appropriate account in your chart of accounts.

- Such entries are crucial for accurate financial reporting and analysis, providing insights into the company’s operational performance and financial health.

- When a customer returns something they paid for with credit, your Accounts Receivable account decreases.

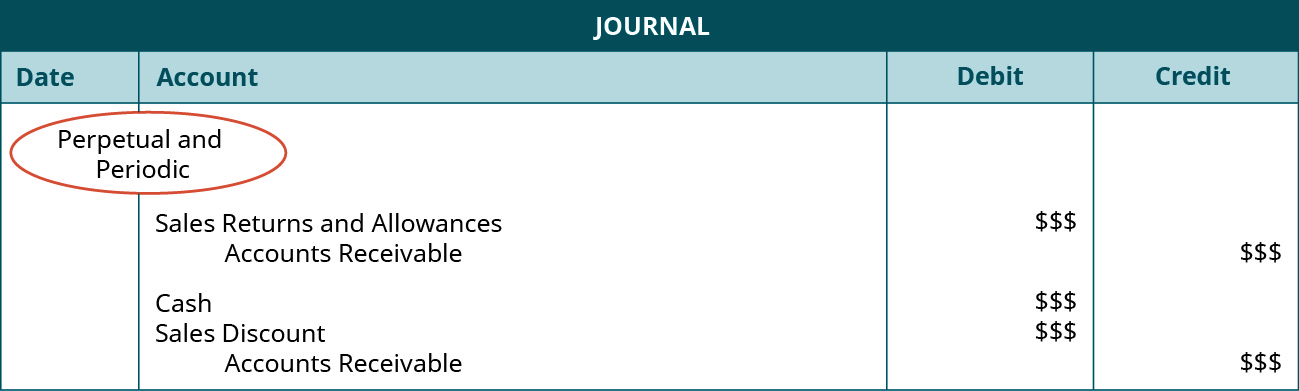

When return goods are given by the customer, a journal entry is required in two steps. Then, an adjusting journal entry can be made to show that payment has been received. All returned items and items subject to discounts/allowances must be reflected in the company's income statement.

Sales Revenue Journal Entry Example

Basically, the cash discount received journal entry is a credit entry because it represents a reduction in expenses. At the end of a fiscal year, the balances in temporary accounts are shifted to the retained earnings account, sometimes by way of the income summary account. The process of shifting balances out of a temporary account is called closing an account.

How to Record a Sales Return for Accounting

But it’s still important to make sure that there’s an accounting record of every sale you make. This way, you can balance your books and report your income accurately. Debits and credits are equal and opposite, so when you increase an account using a debit, you must decrease another with a credit. One of how to calculate lifo and fifo the most common reasons for product returns is when customers find that the item they are receiving does not match the product description. A company, ABC Co., sold goods worth $100,000 to another company, XYZ Co. Companies may offer sales allowances for various reasons, which include the following.

Create a Free Account and Ask Any Financial Question

Based on the nature of the sale, the relevant accounts are determined. For cash sales, the Cash account is used, while credit sales involve the Accounts Receivable account. If the payment was made on June 1 for a future month (for example, July) the debit would go to the asset account Prepaid Rent. Expenses normally have debit balances that are increased with a debit entry.

Discounts allowed represent a debit or expense, while discount received are registered as a credit or income. Both discounts allowed and discounts received can be further divided into trade and cash discounts. Creating journal entries for each of your sales is an essential bookkeeping skill. You’ll need to use multiple accounts to show that you received money, your revenue increased, and your inventory value decreased because of the sale.

Credit memos serve as vouchers for entries in the sales returns and allowances journal. Like debit memos, all credit memos are serially numbered, as shown below. Normally sales returns and allowances are two different kinds of transactions. Still, the accounting treatment for both the transactions is the same, and mostly the same account is used to record both types of transactions. For the seller, revenue can be revised by debiting the sales return account (A contra account by nature) and crediting cash/accounts receivable with the invoice amount.

The company may grant a reduction of the purchase price to customers so that customers can keep the goods. In this case, the customers do not need to return goods back to the company. However, the company still need to make allowance for such transactions in their accounting system. Overshooting in sales is caused due to overstating of sales returns and allowances.

The SRA normal balance is usually a debit balance, unlike sales accounts, which have a credit balance. For a cash sale, debit the Cash account to increase assets and credit the Sales Revenue account to reflect earned income. At the end of the accounting year the balances will be transferred to the owner’s capital account or to a corporation’s retained earnings account.