All pros and cons listed below assume the company is operating in an inflationary period of rising prices. FIFO is a straightforward valuation method that’s easy for businesses and investors to understand. It’s also highly intuitive—companies generally want to move old inventory first, so FIFO ensures that inventory valuation reflects the real flow of inventory. FIFO is an inventory valuation method that stands for First In, First Out, where goods acquired or produced first are assumed to be sold first. This means that when a business calculates its cost of goods sold for a given period, it uses the costs from the oldest inventory assets. The key difference between FIFO and Last In, First Out (LIFO) lies in the order in which inventory costs are assigned to COGS.

Why is FIFO the best method?

Inventory valuation is conducted much differently using FIFO vs LIFO, so it's critical you pick the right method for your business. FIFO and LIFO aren’t your only options when it comes to inventory accounting. Consider the following practices to ensure your FIFO calculations are accurate and up to date.

What Is FIFO Method: Definition and Guide

Whether an e-commerce business, a retail distribution center, or a just-in-time distributor of manufactured goods, FIFO can be an effective means of inventory valuation. In inventory management, the FIFO (First-In, First-Out) method takes center stage, offering what is the purpose of an invoice a performance of unmatched clarity and efficiency in the world of stock control. Imagine your inventory as a flowing river, where the oldest water—your earliest products—moves forward to be used first, ensuring nothing stagnates or loses its relevance.

LIFO and FIFO: Taxes

This is important, since materials may include structural steel, cement, lumber, prefabricated windows, and more. Calculating the cost of goods sold (COGS) with FIFO is a straightforward process. While there are certainly several reasons why FIFO is hard to implement for some organizations, there are extensive benefits to the change. So much so that, with the right WMS in place, you can improve almost every aspect of how your business operates through these changes. Upgrade your business operations with modern software solutions tailored to your needs. The FIFO method, while beneficial in many scenarios, does have some drawbacks.

Do You Report Inventory at Cost or Retail?

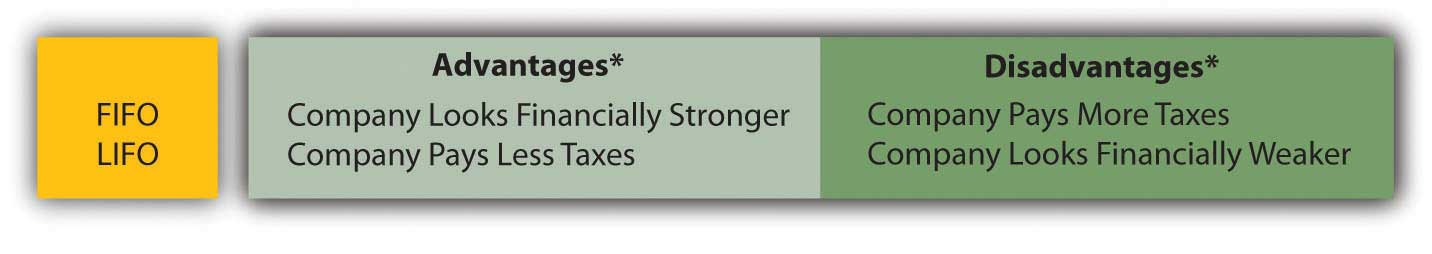

And companies are required by law to state which accounting method they used in their published financials. The company made inventory purchases each month for Q1 for a total of 3,000 units. However, the company already had 1,000 units of older inventory that was purchased at $8 each for an $8,000 valuation. Assuming that prices are rising, this means that inventory levels are going to be highest as the most recent goods (often the most expensive) are being kept in inventory. This also means that the earliest goods (often the least expensive) are reported under the cost of goods sold. Because the expenses are usually lower under the FIFO method, net income is higher, resulting in a potentially higher tax liability.

Strategic Considerations for Businesses

- FIFO is only effective if everyone involved in inventory management understands and follows the principles consistently.

- This article delves into the intricacies of the FIFO method, providing a comprehensive guide on what it is, how it works, and its advantages and disadvantages.

- Discover how cloud-based stock control software helps you boost financial visibility and inventory accuracy across the business, saving you hours of admin time and minimising your stock holding costs.

- FIFO (First-In, First-Out) aligns with this principle by serving as a critical framework in inventory management and accounting.

- Jeff is a writer, founder, and small business expert that focuses on educating founders on the ins and outs of running their business.

- Since FIFO aligns inventory operations with financial reporting, inventory valuation transparency increases.

Choosing the right inventory valuation method is critical for accurate financial reporting and efficient inventory management. While FIFO is a popular choice, it is essential to compare it with other valuation methods to understand its relative strengths and weaknesses. Each method has distinct implications for the cost of goods sold, net income, tax liabilities, and inventory management. In this section, we compare FIFO with other common inventory valuation methods to help businesses determine the best approach for their specific needs and circumstances. It helps businesses accurately track inventory costs, calculate profits, and manage stock levels. The FIFO inventory method has significant effects on company financial reports, tax filings, and strategic choices.

That leaves you with 500 units in our ending inventory, valued at $2 per unit. To calculate the value of inventory using the FIFO method, calculate the price a business paid for the oldest inventory batch and multiply it by the volume of inventory sold for a given period. Industries with highly volatile inventory costs or where the latest inventory costs are crucial for pricing strategies may find FIFO less useful. Additionally, sectors that rely heavily on just-in-time inventory systems might struggle to implement FIFO effectively. FIFO is the best method to use for accounting for your inventory because it is easy to use and will help your profits look the best if you’re looking to impress investors or potential buyers.

In one case, JIT tire distributor Myers Tire Supply used FIFO to handle fast-paced inventory operations. To enhance tracking of its rapidly rotating stock, the company implemented mobile barcoding software to gain pinpoint accuracy and significantly greater efficiency. In this deep dive into FIFO inventory management, we will answer all of these questions and more, highlighting important use cases and the strategic value it offers.

FIFO often results in higher net income and higher inventory balances on the balance sheet. However, this results in higher tax liabilities and potentially higher future write-offs if that inventory becomes obsolete. In general, for companies trying to better match their sales with the actual movement of product, FIFO might be a better way to depict the movement of inventory.

Let’s say that a new line comes out and XYZ Clothing buys 100 shirts from this new line to put into inventory in its new store. Forge strong relationships with your suppliers to ensure their cooperation in adhering to FIFO principles. Communicate your requirements clearly, establish efficient communication channels, and encourage open dialogue. By fostering strong vendor relationships, you can enhance the effectiveness of the FIFO method throughout the supply chain. Because you will run out of the oldest pencils from the first shipment, you fulfill the order using the pencils from both the first and second shipments.